Island nation emerges among Asia-Pacific’s top performers as international tourist arrivals reach 1.52 billion globally in 2025

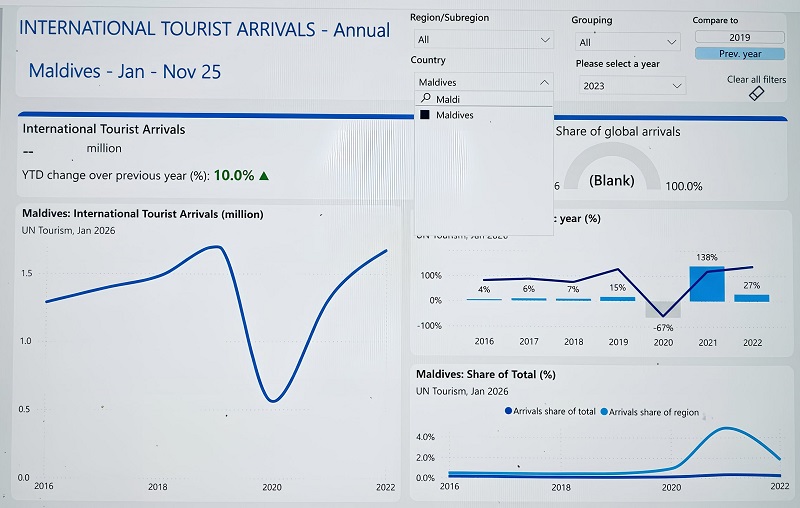

The Maldives has demonstrated exceptional resilience and growth in 2025, posting a robust 10% year-on-year increase in tourist arrivals, positioning the island nation, one among the best performers in the Asia-Pacific region. This impressive achievement comes as global international tourism grew by 4%, reaching an estimated 1.52 billion arrivals worldwide.

According to the first World Tourism Barometer of the year released today January 20, 2026 by UN Tourism, the Maldives’ strong performance reflects the destination’s enduring appeal as a luxury tropical paradise and its successful recovery from the pandemic’s impact on international travel.

UN Tourism Secretary-General Shaikha Alnuwais stated: “Demand for travel remained high throughout 2025, despite high inflation in tourism services and uncertainty from geopolitical tensions. We expect this positive trend to continue into 2026 as the global economy is expected to remain steady and destinations still lagging behind pre-pandemic levels fully recover.”

Maldives Among Asia-Pacific’s Top Performers

The Maldives’ 10% growth places the destination among the best performers in the Asia-Pacific region, which saw overall arrivals of 331 million tourists, representing 6% growth over 2024. While the region as a whole reached 91% of pre-pandemic levels (-9% from 2019), the Maldives has demonstrated stronger recovery momentum.

Top Performers in Asia-Pacific (2025):

- Bhutan: +30% growth

- Sri Lanka: +17% growth

- Japan: +17% growth (through November)

- Republic of Korea: +15% growth (through November)

- Maldives: +10% growth

The Maldives’ double-digit growth underscores the destination’s competitive strength in attracting high-value international tourists seeking luxury island experiences, pristine marine environments, and world-class resort hospitality.

Regional Context: South Asia Recovers Pre-Pandemic Levels

The Asia-Pacific region’s recovery has been a major driver of global tourism growth in 2025:

Regional Highlights:

- Total arrivals: 331 million tourists (+6% from 2024)

- Recovery status: 91% of 2019 pre-pandemic levels

- North-East Asia led regional performance with exceptional 13% growth

- South Asia successfully recovered to pre-pandemic levels

The Maldives, as a key South Asian destination, has contributed significantly to the sub-region’s impressive recovery, alongside strong performances from Bhutan and Sri Lanka.

Asian Market Dynamics:

- Growing middle-class outbound travel from emerging Asian markets

- Enhanced air connectivity across the region

- Visa facilitation measures supporting travel growth

- Strong demand from traditional source markets including China, India, and the Middle East

Global Tourism Reaches New Heights

The Maldives’ success story is set against a backdrop of robust global tourism performance:

Global Statistics:

- 1.52 billion international tourist arrivals globally (+4% from 2024)

- Nearly 60 million more arrivals than 2024

- Return to pre-pandemic growth trends (5% average annual increase 2009-2019)

- Strong demand despite inflation and geopolitical uncertainties

Key Growth Drivers:

- Robust performance from large source markets

- Ongoing recovery of Asia-Pacific destinations

- Increased air connectivity worldwide

- Enhanced visa facilitation measures

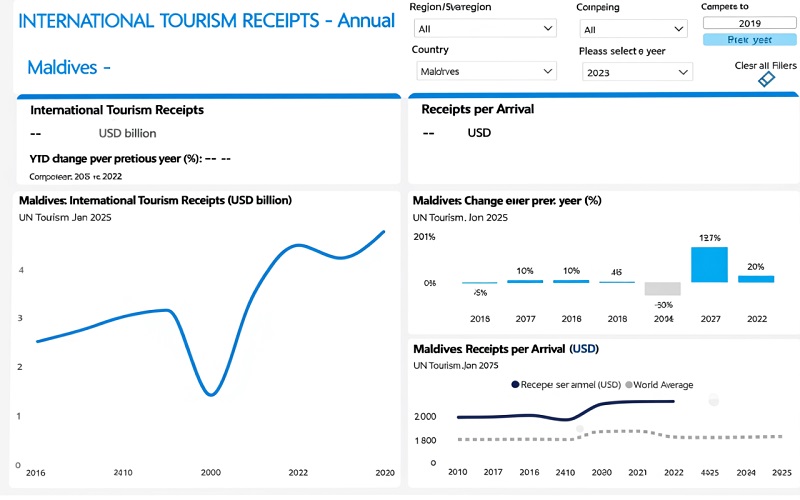

Record Tourism Revenues: USD 2.2 Trillion Globally

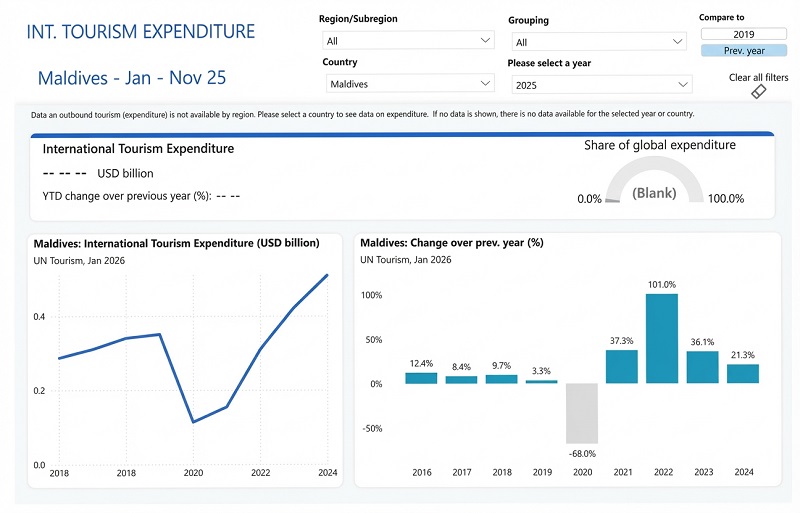

Tourism export revenues reached unprecedented levels in 2025, reflecting not just growth in arrivals but also increased visitor spending – a positive indicator for high-value destinations like the Maldives.

Global Revenue Performance:

- International tourism receipts: USD 1.9 trillion (+5% from 2024)

- Total export revenues from tourism: USD 2.2 trillion (including passenger transport)

- Many destinations posted higher growth in receipts than arrivals, indicating improved yield per visitor

Extraordinary Receipt Growth in 2025:

Destinations reporting solid growth in tourism receipts (in local currencies) during the first 10-12 months of 2025:

- Morocco: +19%

- Republic of Korea: +18%

- Egypt: +17%

- Mongolia: +15%

- Japan: +14%

- Latvia: +11%

- Mauritius: +10%

The Maldives, known for its ultra-luxury resort segment and high average daily rates, is well-positioned to benefit from the global trend of increasing tourism receipts outpacing arrival growth.

Strategic Implications for Maldives Tourism

The Maldives’ 10% growth and strong global tourism performance present several strategic opportunities:

Competitive Positioning:

- The Maldives outperformed the Asia-Pacific regional average (6%), demonstrating competitive strength

- Double-digit growth places the destination among regional leaders

- Performance suggests successful marketing and product development strategies

High-Value Tourism:

- Global trend toward higher spending per visitor aligns perfectly with the Maldives’ luxury positioning

- Ultra-luxury resorts, overwater villas, and premium experiences continue to attract high-spending travelers

- Opportunity to further enhance yield through service excellence and unique experiences

Source Market Diversification:

- Growing Asian outbound markets present expansion opportunities

- Traditional European markets showing recovery

- Middle East remains a strong and growing source market

- India’s potential as a major source market continues to expand

Product Development Opportunities:

- Continued investment in sustainable luxury tourism

- Marine conservation and eco-tourism initiatives

- Unique experiential offerings (diving, water sports, wellness)

- Development of new resort islands and expansion of existing properties

Maldives in Regional Context

South Asia Recovery: South Asia’s recovery to pre-pandemic levels creates a favorable regional environment for the Maldives:

- Increased intra-regional travel

- Enhanced air connectivity with major Asian hubs

- Growing middle-class tourism from India and other South Asian markets

- Regional cooperation on tourism promotion and development

Competitive Landscape: The Maldives competes effectively within a dynamic regional tourism landscape:

- Bhutan (+30%): Niche high-value, low-volume sustainable tourism

- Sri Lanka (+17%): Cultural and beach tourism recovering strongly

- Maldives (+10%): Luxury Island resort tourism maintaining premium positioning

- Thailand, Indonesia: Mass-market beach and cultural tourism

Connectivity Advantages:

- Strategic location in Indian Ocean

- Direct flights from major global hubs

- Growing air connectivity from Asian markets

- Seaplane and speedboat networks connecting resort islands

Infrastructure and Connectivity Developments

The Maldives’ 10% growth has been supported by significant infrastructure and connectivity improvements:

Aviation Developments:

- Expansion of Velana International Airport capacity

- Development of regional airports (Hanimaadhoo, Gan, Maafaru)

- Increased flight frequencies from key source markets

- New airline partnerships and route launches

Resort Development:

- Continued opening of luxury and ultra-luxury properties

- Expansion into previously undeveloped atolls

- Diversification of accommodation types (boutique properties, liveaboards)

- Investment in sustainable and eco-friendly resort concepts

Marine and Transport Infrastructure:

- Enhanced seaplane networks connecting resort islands

- Speedboat and ferry services improving inter-island connectivity

- Investment in sustainable marine transport solutions

Sustainability and Responsible Tourism

As a low-lying island nation vulnerable to climate change, the Maldives continues to balance tourism growth with environmental sustainability:

Environmental Initiatives:

- Coral reef conservation and restoration programs

- Marine protected areas and sustainable fishing practices

- Renewable energy adoption in resort operations

- Waste management and plastic reduction initiatives

- Carbon offset and climate resilience programs

Sustainable Luxury:

- Growing demand for eco-luxury experiences

- Resort certifications and sustainability standards

- Integration of conservation with guest experiences

- Community-based tourism initiatives

Outlook for 2026: Continued Strong Performance Expected

Based on global tourism trends and the Maldives’ strong 2025 performance, the outlook for 2026 remains positive:

Global Outlook:

- International tourism expected to grow 3% to 4% in 2026

- Continued recovery in Asia-Pacific region

- Strong demand from traditional and emerging source markets

Maldives-Specific Factors:

- Sustained demand for luxury tropical island experiences

- New resort openings adding capacity and diversity

- Enhanced marketing in key source markets

- Improved air connectivity supporting access

- Post-pandemic “revenge travel” continuing into 2026

UN Tourism Confidence Index:

- 58% of experts foresee better or much better performance in 2026

- 31% expect similar results to 2025

- 11% anticipate challenges

Opportunities and Challenges

Growth Opportunities:

Source Market Expansion:

- India: Massive untapped potential with growing middle class and improved air connectivity

- China: Recovery of Chinese outbound tourism presents significant opportunity

- Middle East: Continued strong performance from GCC markets

- Europe: Traditional markets showing sustained recovery

- Asia-Pacific: Growing intra-regional travel from emerging markets

Product Innovation:

- Wellness and health tourism (spa, yoga, meditation retreats)

- Marine experiences (diving, snorkeling, marine conservation)

- Cultural tourism (local island experiences, Maldivian heritage)

- Adventure tourism (water sports, surfing, sailing)

- Events and MICE (meetings, incentives, conferences)

Challenges to Address:

Economic Factors:

- High inflation in tourism services globally

- Travelers seeking value for money even in luxury segment

- Economic uncertainty in some source markets

- Currency fluctuations affecting pricing competitiveness

Operational Challenges:

- Elevated costs for resort operations and maintenance

- Supply chain logistics for remote island locations

- Labor recruitment and retention in hospitality sector

- Infrastructure development in outer atolls

Environmental Risks:

- Climate change and sea-level rise

- Coral bleaching events

- Extreme weather events

- Plastic pollution and waste management

Geopolitical Factors:

- Global geopolitical tensions affecting travel confidence

- Trade tensions potentially impacting source markets

- Regional stability and security considerations

Strategic Priorities for Sustained Growth

To maintain and build upon the strong 10% growth achieved in 2025, Maldives tourism stakeholders should focus on:

1. Market Diversification:

- Intensify marketing efforts in high-potential emerging markets

- Develop tailored products for different market segments

- Strengthen presence in traditional European markets

- Capitalize on India’s proximity and growing outbound market

2. Sustainable Development:

- Implement rigorous environmental standards for new developments

- Invest in renewable energy and sustainable operations

- Protect and restore marine ecosystems

- Ensure tourism development benefits local communities

3. Enhanced Connectivity:

- Support airline route development from key source markets

- Improve inter-island transportation infrastructure

- Develop regional airports to unlock outer atoll potential

- Facilitate visa and entry procedures

4. Product Excellence:

- Maintain world-class service standards

- Innovate with unique experiences and offerings

- Invest in staff training and development

- Differentiate through authentic Maldivian hospitality

5. Value Proposition:

- Balance luxury positioning with value perception

- Offer diverse accommodation options across price points

- Create compelling packages and experiences

- Demonstrate clear value relative to competing destinations

Industry Indicators Supporting Growth

The Maldives’ strong performance is reflected in various industry metrics:

Air Connectivity:

- International air capacity and passenger traffic grew 7% globally through October 2025 (IATA)

- New routes and increased frequencies to the Maldives

- Enhanced connectivity from Asian and Middle Eastern hubs

Accommodation Performance:

- Global hotel occupancy at 66% in November 2025 (STR data)

- Maldives resorts maintaining high occupancy rates

- Strong advance bookings indicating continued demand

Visitor Spending:

- Global trend toward higher receipts relative to arrivals

- Maldives’ luxury positioning capturing high-spending travelers

- Increased length of stay and per-guest spending

Regional Cooperation and Tourism Development

The Maldives benefits from and contributes to broader regional tourism initiatives:

South Asian Tourism Cooperation:

- Collaboration with regional tourism boards

- Joint marketing initiatives

- Sharing of best practices in sustainable tourism

- Regional events and tourism exhibitions

International Partnerships:

- Participation in major travel trade shows (ITB, WTM, ATM)

- Partnerships with international tour operators

- Airline alliances and marketing partnerships

- Hospitality brand investments and management agreements

Conclusion: Building on Success

The Maldives’ impressive 10% year-on-year growth in 2025 demonstrates the destination’s enduring appeal and successful positioning in the global luxury tourism market. As one of the best performers in the Asia-Pacific region, the Maldives has shown remarkable resilience and adaptability.

With global tourism reaching record levels of 1.52 billion arrivals and USD 2.2 trillion in export revenues, the Maldives is well-positioned to capitalize on continued strong demand for tropical luxury experiences. The destination’s unique combination of pristine natural beauty, world-class hospitality, and strategic location makes it a compelling choice for high-value international travelers.

Looking ahead to 2026, the Maldives faces a favorable outlook supported by:

- Continued recovery in the Asia-Pacific region

- Strong demand from traditional and emerging source markets

- Enhanced air connectivity and infrastructure

- Growing global interest in sustainable luxury tourism

- Positive expert confidence in tourism growth

By focusing on sustainable development, market diversification, product excellence, and enhanced connectivity, the Maldives can build upon its strong 2025 performance and secure its position as the world’s premier luxury island destination.

The tourism sector’s success is vital to the Maldivian economy, providing employment, foreign exchange earnings, and development opportunities. Maintaining this growth trajectory while preserving the natural environment that makes the destination special will require continued collaboration among government, industry stakeholders, and local communities.

As the world continues to recover from the pandemic and travelers seek extraordinary experiences, the Maldives stands ready to deliver the paradise experience that has made it one of the world’s most desirable destinations.

About the Data:

Statistics are based on the UN Tourism World Tourism Barometer, first edition 2026, which provides comprehensive data on international tourism performance by region, sub-region, and destination. The Maldives’ 10% growth figure reflects year-on-year performance for 2025 compared to 2024.

Leave a Comment